Terry Martine 0:10

All right, everybody. Thanks for joining today. We have john Clark on the call on the show today. And we’re gonna talk about Medicare, how Medicare came about what the pricing of Medicare is how you sign up pretty much everything Medicare that we get from clients questions. And john, you want to introduce yourself.

John Clark 0:27

My name is john Clark. And I’ve been doing Medicare since 2006. I started as a captive agent with mutual Omaha decided to leave the captive position because I wasn’t able to offer my clients the numerous products available for Medicare, and started an agency been selling all the different brands very versed in Medicare, how it relates to Social Security, but it’s all tied together, I thoroughly enjoy helping seniors slepping their Medicare options that are available for them.

Terry Martine 1:00

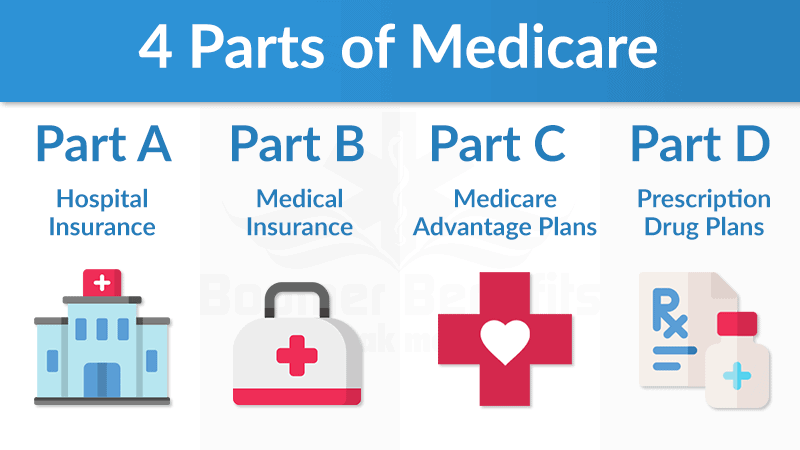

And so why don’t we jump in a little bit? I know, we get a lot of questions about Medicare. If you’re turning 65, you know more than we do that you get at least 50-60 different mailers, they try to make it very complicated. But Medicare is super simple to understand. I know there’s only four parts, but you want to describe what the four parts are.

John Clark 1:20

Sure. So there’s a very, very easy way and I’m going to share with you, the easiest way to remember it is there are four parts to Medicare. And if you use a visual of your hand, and you use your thumb is Part A you think about what hospital, you would go to that would be your part A that’s the hospital side of Medicare, the trigger finger, which would would be the Medicare Part B would be your doctor and visualize who your doctor is for specialists that we use. So there you have Part A and Part B, which is the hospital and the medical side. Now I’m going to skip Part C for a second I’m going to circle back to and I’ll explain the reason why. So the ring finger is the part D which is very simple, which is a prescription drug plan that you’re required to have. If you have Part A and Part B, and we’ll get into greater discussion about explaining how the Part D works. In 2003, Medicare came out with a call Advantage plans. And what it consists of is Part A, Part B and Part D is a combination. And those are managed by private insurers. Now, those are private insurance health care company. So what happens is, if you consider taking an advantage plan, you are giving up your original Medicare Part A and Part B, the last finger, your pinky finger would be considered and it’s really not a part of Medicare, but I kind of have it laid out that way would be the Medigap policies, the Medicare Supplement policies, and those are designed to fulfill closing the gap on the Original Medicare Part A and Part B, where Medicare pays 80%. The Medicare gap would pay the other 20% making good completely hold. I get this question a lot because on the pricing side of it, and I know we’ll cover pricing in a second. But on the Advantage plans. A lot of times people ask me so you don’t pay anything for the Advantage plans? How do the insurance companies make any money? You want to touch on that? Sure. When you’re considering Advantage Plan in particular, in certain states, there are zero premium Advantage plans. The caveat is that you have to stay within the network that they have. You’ve got to see their doctors and utilize their providers, hospitals, clinics, specialists. And by doing that they can manage your health care. That’s why they call it you know, an either an HMO or PPO. When I mentioned previously, you give up your original Medicare and go with a private insurer. What happens is there’s a contract arrangement between the Medicare and they pay the private insurance to manage your health care. Currently, the private insurer would receive about $18,000 per person to manage your health care in that $18,000. Let’s say it’s HMO through Humana or whoever that type of plan. So Humana would be getting paid $18,000 a year to manage my plan. Correct? Correct. Okay, but I don’t pay anything out of pocket. So it seems like pretty good deal. But what are the downfalls of that? Okay, so, you wouldn’t pay a premium. However, let’s say for instance, on an HMO, a primary doctor visit would be $10 or $5 or zero. Okay, that would be stunning.

In that way, a specialist might be 35 or $50. All the other services will have a fee associated, known as a copay or coinsurance. That’s where the out of pocket would affect the person, the beneficiary on Medicare. So there really isn’t a free pass on it. Now, in terms of ensure that company, if you are a person that never got sick, and you only went to the doctor twice a year, well, you’re an extremely profitable patient, because you didn’t you have any claims you didn’t charge anything. Now, on the flip side, let’s say that you are that particular year, you are going to doctors on a numerous numerous times, and you require a lot of services that may be exceeded the 18,000, then you would be costing them. So it’s insurances a balancing act, between loss ratio and claims, keeping you healthy is going to prevent them from having to spend a lot of money.

Terry Martine 6:04

So that’s why on some of these HMOs, their plans to get you like gym memberships, they throw in a couple of beneficiaries. I heard about one giving a Fitbit, are you familiar with any media with that? Two things with that one is not everybody is comfortable with the insurance company knowing exactly what their heart rate is 24 hours a day. You know, that being said, but I guess that’s all part of their plan, right? Their plan is to make sure that you get your steps in and you’re being healthy, you’re walking, you’re going to the gym. So that prevents them from eating into that 18,000 that they’re getting, right?

John Clark 6:34

Well, it’s Managed Healthcare, they want to make sure they’re you remain healthy, if they can keep you healthy and out of the hospital, which is extremely expensive. guy got a visit to the ER room is an average of 30 $500. Let’s say you’re taken to the taken by ambulance, add another $800. So now all of a sudden, you’re at the 4000 Plus, you spent one night in the hospital, let’s say that’s 20 grand. Well, now they’re upside down. Right? So they keep you healthy and keep you active and health on the right diet, watching everything, then you’re going to be a great client for them. And good for you too, as well as an individual, you know, you’re

Terry Martine 7:15

sure you’re healthy. Somebody

John Clark 7:16

wants to get sick.

Terry Martine 7:18

No. And so the the issue there, though, and I get this question too, a lot, a lot of the teachers and folks that retire, want to travel, right, that’s probably 75% of most folks that retire. They’ve got travel plans. So if they get the HMO style plan here, they get the advantage plan. And that suppose they go to Seattle, and they’re, you know, do their thing, what happens if they fall down? Or they break a leg? Or what happens at that point?

John Clark 7:46

Well, at times, it’s considered an emergency. So they would have access to our network facilities. However, there’s a cost to that. And traditionally, it’s about 25% more. So you do get the service, you’re just want to pay for having access to that service. Okay. And,

Terry Martine 8:04

and the other part too, is that what is the max out of pocket? Let’s suppose you get the Advantage Plan. What is the max add up? And by the way, this 2021? And I’m sure it varies year to year, but what would be the max out of pocket for that?

John Clark 8:16

Alright, very good question. So what will happen is gonna vary depending on the carrier, okay? It can be as low as 3500 as high as almost 7500. Okay, that’s going to continue, that’s a very fluid number, that’s going to vacillate.

Terry Martine 8:30

Okay? And that changes year to year,

John Clark 8:32

that’s not a year and by carrier by carrier.

Terry Martine 8:36

So if somebody gets into the Advantage Plan, and they’d say up, you know, what I rather be back into the traditional Medigap plans, how do they get back? Or is there a waiting period? Or can they even get back?

John Clark 8:49

So a couple things? That’s a that’s another good question, because it happens a lot. We have some clients that tried an advantage plan, maybe didn’t like it and want to go back to the original Medicare because they wanted to have a little more flexibility and a little more freedom as to their choice of providers. And being able to travel. There is a disenrollment period known as open enrollment that occurs between January and March, where they can go back to original Medicare. And that’s the first step they have to do is get back on Original Medicare. Remember now, when they first turned 65, or they left that employer during a certain period, they’re called Initial Enrollment or guaranteed issue. There are no health questions that are asked if they’re going back from an advantage plan to Original Medicare. They will have to answer underwriting questions in order to be eligible for supplements.

Terry Martine 9:48

So in theory, you could sign up for the Advantage Plan and then something come up and try to get back on the traditional Medicare plan and not be allowed right because you have to go through underwriting

John Clark 9:59

that Correct. And it depends on which carrier because some of them have a two year wait period, on on I call a hiccup, something happened to you whether you had a cardio issue, or you had a bone density concern might prevent you from signing up immediately.

Terry Martine 10:18

And so one of the other things that pops up quite frequently is that we’ll have people work past age 65. I know it’s 65, you can sign up for your part A, which is great. And then you can continue working and continue coverage through, for instance, Palm Beach County through UnitedHealthcare. They just continue their health care benefits to the school district, they retire at age 66 or 67. Whatever the case is, I know there’s a form that they fill out to send into Medicare, in order to get enrolled for part B, a lot of folks think that you don’t sign up for Part A and B until after you retire. But that’s not the case you do sign up for part A when you turn 65. Right?

John Clark 10:57

Yes, everybody has to take part day, when you get 65. The part B is optional, at age 65. And you brought brought up a very good point those people are working longer. So if they’ve got an employer plan, you can utilize the employer plan to act as your part B medical side. And you but you have to have the part de.

Terry Martine 11:20

And so let’s let’s change gears a little bit. So the advanced plans talk about traditional Medigap plans. By the way, Medicare is going to cost you how much in 2021?

John Clark 11:31

Well, let me explain what part A covers and understand how that how that is broken down. So part A, you’ve been paying all these years into Medicare through your payroll deduction, the value of that if I was to put $1 number on, it’s about $438 for your part day. So you’ve kind of earned them through your contributions. The part B is is subsidized, but not to the to the max, it’s going to be based on your income. So depending where you fall on the income scale, if you’re $85,000 as a single below, and 170,000 as a married couple than that parpi premium is going to be right now. 148 50, I believe.

Terry Martine 12:16

Okay. And we’ll put the chart up. The interesting thing here is that Medicare I know, looks back two years for 2021. It would be looking at what you earned in 2019. Correct? Correct. And it’s banded, like you said, the first band is 85,000. And on the chart, I know it goes up substantially. I think the highest is around $450 a month, there’s something for high income earners,

John Clark 12:40

I think it’s close to 501 of the things you’ve got to be very sensitive to. And this is where Terry could really help you is because if you elect to take certain assets, then it’s going to affect your adjusted gross income, you could get hit with that Irma penalty and put you in a higher Part D premiums, that does make a difference. If you’re deciding to take an early withdrawal out of your pension plan. You’re going to pay dearly for that on your Medicare.

Terry Martine 13:13

Okay. Yeah, I just pulled up the chart. It’s $504.90. For there is a waiver, and I’ve had clients, let’s suppose you’re working. And in 2019 2020, you’re working, you retire today, there is a waiver, and I don’t know the success rate on the waiver. But you can fill it out and say that there’s been a life altering I forget exactly what the the statement is on the form. Have you have you had any clients fill that out and get that waived?

John Clark 13:43

Yes, we are. We offer it to every client that is looking to retire, that is a high earner, because there are eight exemptions. And one of which is if you’re looking to retire like permanently and not work, then that would qualify if you’re moving got divorce got married? There are a number of factors that are in there. Right. I am told that the approval rate for it is about 99%.

Terry Martine 14:11

Yeah, I haven’t had anybody say that they have not been able to get that. So do you know the specific form number? We’ll try to find that and put it up on the website?

John Clark 14:21

I’ll have to get that to you there is a specific form is called the arrma form. It’s an income related monthly adjustment. Okay, Medicare adjustment.

Terry Martine 14:29

Yeah, this is good to know, because a lot of folks don’t know this, that you can get that increased premium waived if you fill out that form. And like you say there’s about a 99% chance that they’re going to accept it. I mean, how would they argue the fact that you retired and your income went down? That it’s not a substantial decrease in your income.

John Clark 14:47

So right, you just want to be careful and looking at the whole full full portfolio of finances that you’re not going to trigger it again, because they’re not going to be forgiving at that point.

Terry Martine 14:58

So if your retirement in Come is gonna be on one of those bands may not be advantageous to fill it out, right?

John Clark 15:06

It would require sitting down with you and making sure that you’re going to do it correctly.

Terry Martine 15:10

Okay? We don’t want anybody trouble. So what else? Okay, so you’re going to sign up and Medicare, when you sign up for the part B is going to run you again, it’s about $150, a little bit less than $150 this year, and it goes up a little bit each year. I think this year, it went up by five or $6. Right there abouts. So it is going to go up a little little bit at a time. So whether or not you get the Advantage Plan, or you get traditional Medicare Medigap policy, it is still going to cost you the $150 a month, right?

John Clark 15:42

That is correct. There is there are no exemptions unless you fall below the poverty income level to be exempt from paying the Part B

Terry Martine 15:52

just so everybody knows that you are going to be paying $250 a month well regardless of what plan you pick, as long as you sign up for Part D which, which is another thing too, is that we had one client did not sign up for part B when he turned 65. And then when he returned, it was 69. It’s close to 70 years old. He did finally sign up for part B because he started having some medical issues, you want to talk a little about what happens then and why he got hit with a surcharge. Sure.

John Clark 16:21

So what happens is you if you delay your part being and the delay is a credible reason, for instance, you’re you continue to work, that would be something that Medicare would consider credible coverage, you have to have credible coverage. And in this particular case, this individual may have felt, hey, I don’t need it, I’m healthy, then all of a sudden, he’s not feeling too well. And he’s got to initiate the Part B. Well, Medicare is going to charge you a 10% penalty for not filing correctly and in a timely fashion. Unfortunately, that penalty is lifetime. So as is, so you want to definitely be sure that you’re aware of the guidelines, the eligibility requirements, and not get yourself in a position where you’re going to be hit pretty hard financially by the penalty.

Terry Martine 17:14

Right? And it’s 10%. Now the 10% of the Part B premium, or what are they charging you a 10% surgery, you’re

John Clark 17:20

gonna add the 10% on to your part D.

Terry Martine 17:23

Okay, so if it’s $150, every year you delay, it’s going to be a $15 surcharge it roughly.

John Clark 17:29

Yeah, but remember, that’s every month.

Terry Martine 17:33

Right? So I mean, it could go every month, right? And so it could cost you substantially

John Clark 17:41

less, particularly if it’s a lengthy period. Okay, now 10 years would be very expensive.

Terry Martine 17:47

Yeah, it would cost you a lot of money. And again, he just didn’t want to sign up for part B because he didn’t want to spend the money but ended up paying the surcharge. So it’s important to know that 65, you do want to get this unless you have an employee plan or employer plan, or continue your existing coverage. The interesting thing about a lot of people that are in the fers system, and this is just for Florida Retirement System is that they get paid $5 a month for every year that they were working in the system up to 30 years. So a lot of folks get that extra $5. And you know, they work 30 years, it’s $150 a month. So that helps offset some of these costs as well. The other question I have or I get quite a bit of as well. Is your what what plan should I get? There’s a lot of different plans abcdefg and pick your letter, but what what plan suits most people right now, today?

John Clark 18:40

Well, right now, the most comprehensive plan would be considered the Plan G, all insurance have to meet the same benefits in providing what a particular plan offers. So a Plan G would be considered write down the most comprehensive plan available, then you would have other plans that would offer less benefits, like a plan and would have some different benefits than a Plan G and of course, like I said, the Plan G is the top the top of the tier.

Terry Martine 19:10

And we see that in our practice here as well. 99% of people pick Plan G was Plan F last year. And why does Medicare go away from one plan and move to the next they have too many enrollees? or Why does that happen?

John Clark 19:25

What happened was under the MACRA in 2015, your legislators thought that the Plan F was too rich and benefits because it included the Part B deductible where in the plan G you have to pay the deductible first, then your benefits kick in. So it was basically a very large pool of people under plan house that was costing a lot more money to Medicare. You say that they’re paying the deductible but what was the deductible under Plan G now

Terry Martine 19:57

that you would not have to pay if it was Plan F

John Clark 20:00

$203

Terry Martine 20:02

Okay, every year, your first $203 that you use a benefit will come out of your pocket will come out of you pay the two or three first. Okay, once

John Clark 20:12

that’s paid, then it pays 100% after that 100%.

Terry Martine 20:17

And so the other question we get, we get this all the time is that if somebody travels overseas, which plan covers them when they go overseas?

John Clark 20:25

Okay, first, first of all, I would always recommend anybody going abroad is to purchase the travel insurance either through their credit card, or through their travel agency or cruise. by them. Medicare is not going to cover everything. In fact, it’s very limited. It’s only 20% of $50,000 is the cap. And if you’re stuck abroad, and you need to be airlifted, you’re going to need a charter flight with a pilot, the copilot in an air nurse plus the fuel of the aircraft and the rental the aircraft, you’re looking at a couple of $100,000 that are going to come out of your pocket.

Terry Martine 21:04

Yeah, I have a buddy that has pilot’s license. And that’s what he does for a living is he airlift people back to the states for emergencies? You said it’s it’s it’s how much of the 50,000. So how much let’s suppose I get sick overseas.

John Clark 21:20

It’s a $50,000. Cap, that’s it, cap, okay, and it’s a 20% deductible that you’re going to pay. So what’s that about? 10 grand.

Terry Martine 21:30

And even if you had any sort of medical care advantage, or any of these other plans, you’re going to be out of pocket that money.

John Clark 21:37

Yeah. I mean, realistically, I even buy domestically when I travel, particularly if I go to Hawaii or Alaska, I buy the extra insurance.

Terry Martine 21:48

Just so you know, you can get lifelight a backpack.

John Clark 21:51

But you know, you’re in the US, you’re going to be fine. But you know, I know a lot of people that go to Costa Rica, they go to Mexico,

Terry Martine 21:58

we have plenty of people to travel all over whether or not they go to Alaska and take pictures of bears or whether or not they’re going the scattered all across. I mean, not this year, but certainly in years past, people have done a lot of traveling. Yeah, that’s always good to know. So the result there, your advice would be to get the travel insurance and travel. And most agencies are going to offer that if you booked sort of a package deal. Anyhow, I would think

John Clark 22:22

correctly. Sometimes a lot of credit cards, offer that as an option as well.

Terry Martine 22:28

And let’s talk a little about what Medicare does not cover as far as vision and dental. I get a lot of folks, they ask, you know, does Medicare cover my vision and dental. And it’s not really for preventive, right? You want to review that.

John Clark 22:43

So Original Medicare when it was created. And you’ve got to remember this is Korea, this was done in the 60s. And longevity at that point when somebody reached 65, or 70. That was considered relatively really old considering back in the 40s, someone making 60 years of the age of age was almost unheard of. So fast forward. So when they created Original Medicare, it was not part of the program, there is legislation that would add it but it hasn’t gone forward at all. However, in the Advantage Plan, they have basic preventive, dental and vision with a cap of maybe $1,000 for dental, some are a little bit richer. Same thing with the vision where you might be able to go and get a prescription check, get free glasses, but that’s about the extent of it.

Terry Martine 23:41

So what do people do when you get other than just not have coverage? Or?

John Clark 23:46

Well, there’s always options. And I always say then the option would balk would be to purchase a standalone, dental and vision plan. And I will say this, you know from a personal experiences because as we get older, don’t forget, our eyes are going to change and our our teeth are going to deteriorate, and you might need those taken care of or replaced. So the biggest thing that’s happening now or call the implants, and those are very, very expensive procedures not covered by Medicare not covered under Advantage plans. So you either have to write a check, or you have to buy a standalone plan that offers that. And there are plans that are available,

Terry Martine 24:28

that would not be considered cosmetic because you’re actually all losing. Okay. So it would be covered under the plan. Under a standalone plan. Yes. Okay. All right. And they have different thresholds as to how much they recovered, right?

John Clark 24:42

Correct. And it’s not, you know, it can vary from 2500 to $5,000. You know, that would be the full benefit for that year. So if you’re having one implant that cost you $4,000, then you’ve pretty much exhausted almost the $5,000 benefit.

Terry Martine 24:59

Okay, So yeah, it’s no wonder I see people going to Mexico to get implants and all this kind of thing. I mean, I hear about it all the time. But I guess you probably heard about it is

John Clark 25:08

less expensive if you want to travel there. I know a lot of places in Guadalajara, but

Terry Martine 25:16

I heard about it all the time. If people say I’m gonna go to Mexico, get my teeth, but I was like, Okay, well, I guess

John Clark 25:22

suppose here, it’s really interesting, because one of the plans that I offer that that is offered allows people to cross over into Tijuana, right in California. And it’s covered. They cover that plan, but just only in that geographic area. That’s funny.

Terry Martine 25:39

Yeah, I went to San Diego State. So I’m familiar with deewana. But yeah, yeah, it’s that’s your I go down there? Well, yeah, I guess a lot of people do any other things that you can think of that clients are running into or issues. I know that before people used to run down, so security office to get signed up, it was closed for a period of time, what’s the easiest way to get started? Or how do people get started? Now,

John Clark 26:01

the easiest way to do it, and I recently had to do it because I became eligible for Medicare, is you go to the Social Security site, because that’s where it’s linked with it, but you’re not going to be filing for benefit claims, just the Medicare portion. And it’s a very, very easy link, I think it’s ss a.gov. And all you’re going to do is establish an account process is once that account is established, you’re not going to be able to proceed into you receive a letter from them. And understand this Social Security will never call you or text you unless your account is set up. Okay, they’re going to receive a security pin number. And once you have that pin number, that’s the number that you will insert into your app, your your process, then that will allow you to complete the application. Now once that is done, and you’re within the eligibility period, they will send a letter out to you verifying who you are, what your effective date is, and what the Medicare ID number of you, that will you’ll be assigned. So what I always tell everybody, once you file, please open all your mail, because I’ve had many clients that look at it because they’re getting bombarded with mail, they trash it, and that’s the letter that they needed 10 days later, okay, they will get their ID card, it comes in a very generic white envelope. And you want to be able to make sure you open that up. Once you have that. That is the time that you can call Terry and start the enrollment process for Medicare.

Terry Martine 27:45

You know, just as a side note, I do have a client that he was working with Palm Beach County School District had Part A 66. Now, so he needed to sign up for part B. And he retires at the end of the month, which in today’s March. But he started this about six weeks ago. And he still has not received the letter yet saying that as part V is active, which is an issue because he can’t sign up for Medicare for the part B or he can’t get a supplement yet. So he’s in theory, he could potentially be because he hasn’t got his letter yet. He may not have health care coverage for a period of time until he gets that form. Because I know the carriers won’t won’t cover you until Medicare says yeah, this person is enrolled and he has Part B with the active date which is going to be on your Medicare card.

John Clark 28:34

Correct. What I’m recommending is don’t think that you’re going to be able to turn the switch on and go Hey, I’m gonna apply for my my my Medicare a month out because of COVID. In the offices that are closed, there is a significant delay, in terms of of initiating that so you’re probably better off to do it 90 days out, that’s the furthest that you can you can go out is three months in advance. Don’t wait till the last 30 days that you’re deciding to turn on Medicare, you want to be very proactive in getting this done. Because if not, you’re going to miss the window.

Terry Martine 29:13

What I’ve been suggesting to clients is on their calendar, most most people have birthday calendars, things like that, to mark down three months out prior to that to make sure that they’re either calling Medicare getting the form or they can get the form on our website. But it’s real important that you get signed up sooner sooner than later because if there were an issue or the mail got lost or any of these kinds of things can happen you’ll have to reapply. And if it takes four weeks for your first application to figure out that hey, we didn’t get your form or get lost in the mail. You’re out you know you’re cutting it close to not having coverage when it comes time. We could do a whole nother one on social security on when to take Social Security so I’ll leave that for another show any anything else that you think clients should know or that people should know? We they can always give us a call come over enrollment, which open enrollment starts when again?

John Clark 30:03

Well, there’s a couple, you when you turn 65, that’s your initial enrollment. Okay, and you’re going to be an offer, you’re gonna have an opportunity, it’s a one time election of not having any underwriting questions asked whatsoever. It also applies when you leave an employer. However, that window is only for 63 days. So don’t delay in making and being proactive. Again, I can’t stress enough, you want to be proactive, you also want to do business or have assistant be assisted by a licensed professional agent that’s been in the Medicare arena business for a number of years is very versed, that can give you all the options that are available. And the last thing I want to say is, you know, working with an independent agent is probably very beneficial, because they can offer you all the products that are available. And I’m not saying that it’s not good to deal with a captive agent, but that’s all they can offer you. A

Terry Martine 31:05

captive agent would be somebody that can only represent one particular insurance company,

John Clark 31:10

that is correct, where an independent, can really present you a number of options choices, and you can select the best one that’s going to fit your needs medically and financially.

Terry Martine 31:22

But I guess it’s a good thing that we’re both independent. So that’s, that’s a plus.

John Clark 31:26

The reason why

Terry Martine 31:27

Yeah, and one quick or one quick follow up to the pricing. You know, it’s interesting, you know, Medicare for my understanding gets price per County, the insurance carrier is gonna price out what they’re gonna charge the client at the end user, whatever the mount it is, but it’s gonna be based on county by county.

John Clark 31:46

Correct. So all plans supplement Lance’s and Advantage plans are are all controlled by your residents by zip code. That’s what dictates your premium?

Terry Martine 31:59

What are the differences? Like if you were in Martin County versus Miami? Is it a big swing is a $10? what’s the what’s the difference there?

John Clark 32:08

It can be significant. I can tell you right now that Dade County is much more money than Martin County, as an example, Palm Beach County could be less money could be a little more competitive. Depending on the carrier, though. That’s the advantage of dealing with an independent agent because they’re able to tell you exactly XYZ carriers price versus another XYZ. And one

Terry Martine 32:33

final thing is Plan G. If you have five different insurance companies offering Plan G, what’s the difference in the plan G? Is there a difference? Or what what what can you get? Or is it regulated by the government who dictates what a Plan G covers?

John Clark 32:49

So first of all, all the premiums have to be approved by the state Insurance Commission. So the state of Florida is one that’s regulating it. And they can’t just arbitrarily an insurance company arbitrarily go, Hey, we’re gonna have a rate increase, because we want it they have to justify the rate increase. So we

Terry Martine 33:08

see that by the way, we see that a lot on Long Term Care policies, long term care policies back in the day were very underpriced. And it seems like every year I think one of my clients got a notification that’s going up 25% but because of the regulations, they couldn’t, they couldn’t get you all 25% in one year, it was staggered over four year period. Or she can keep Yeah, you know, thank the government for that. But I mean, the 25% increase is still there. And again, what we’ll do long term here another episode but

John Clark 33:39

so so what the key the key things to look at is number one, is there a financial standard? How do they How do they stand financially on paper? Are they a rated plus? Okay,

Terry Martine 33:49

okay. And who rates them s&p

John Clark 33:53

Okay. P and then the, you know, their outlook by moody. The other thing you want to look at is longevity, how long have they been doing Medicare providing the brand new to the market and they’ve been in the business less than a year, they may be prone to having substantial increases very quickly, versus somebody who’s been in the business for 50 years. Okay, that’s one other thing. The other thing to look at and ask is what’s their loss ratio? Now most people don’t know what loss ratio is but basically what it is is what are they paying out in flames? What percentage are they paying out? So sorry, that’s a woodpecker that’s it is fine to go

Terry Martine 34:33

Yeah, Woody Woodpecker out there telling you Okay, it’s time to and and this. I got a lot of good information. Again, if you need questions answered, obviously, John’s a wealth of information. I mean, as you can tell, he’s 65 You don’t look a day over 64 By the way, you’re very

John Clark 34:51

generous.

Terry Martine 34:54

Yeah, questions, feel free to give us a call. I’ll in the show notes. I’ll have our contact information and Also, we’ll include some of these website links from Medicare and Social Security and so forth and so on. JOHN, I appreciate your time. Yeah. Thank you very much.

John Clark 35:08

Thank you so much, buddy. All right. Thank you.

Speaker 35:12

You should consult a financial advisor familiar with the specific circumstances of your unique financial situation before making any financial decisions. Nothing in this broadcast constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature, and are not a guarantee of future returns. Terry Martine is an investment advisor representative of FRS investment advisors, a Florida investment advisory firm.